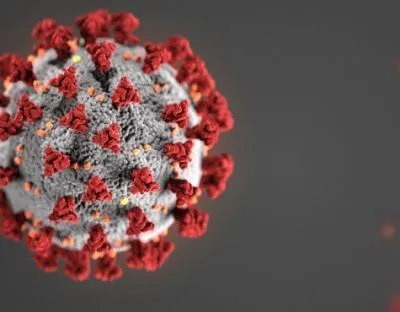

The Employee Retention Credit (ERC) is a refundable tax credit designed to encourage businesses to

keep employees on their payroll during the COVID-19 pandemic.

Here’s an overview about the history of this program including details about the moratorium which is no

longer in affect:

Employee Retention Credit Overview:

Purpose: The ERC was established to help businesses retain employees by providing a tax credit

against certain employment taxes for qualified wages paid after March 12, 2020, and before

October 1, 2021 (with certain exceptions extending to December 31, 2021).

Eligibility: Businesses were eligible if they experienced a full or partial suspension of operations

due to government orders or had a significant decline in gross receipts.

Credit Calculation:

o For 2020, the credit was 50% of qualified wages up to $10,000 per employee, equating

to a maximum credit of $5,000 per employee.

o For 2021, it increased to 70% of qualified wages on up to $7,000 per employee per

quarter, with a maximum of $21,000 per employee for the year.

Moratorium on ERC Processing:

Initiation: The IRS announced a moratorium on processing new ERC claims on September 14,

2023, due to concerns over rampant fraud and a surge in questionable claims. The initial plan

was for this moratorium to last until at least December 31, 2023.

Extension and Impact:

o The moratorium was extended multiple times due to ongoing issues with fraudulent

claims and the need for increased compliance reviews. This resulted in significant delays

for legitimate claimants, with processing times for existing claims slowing down

considerably.

Partial Lift of Moratorium:

o On August 8, 2024, the IRS announced it would begin processing claims again, focusing

first on claims filed between September 14, 2023, and January 31, 2024. This partial lift

categorized claims into “high risk” for denials and “low risk” for quicker processing,

aiming to balance between preventing improper payments and ensuring legitimate

businesses receive their credits.

Current Status:

o As of the latest updates, the IRS continues to process claims, with a focus on those

identified as low risk from before the moratorium and some filed during the moratorium

period. However, the processing remains slow due to the complexity of the credit and

the volume of claims.

o The program remains open as an attempt to cancel it by Congress failed.

If you did not receive your ERC for your business, you should see if you can legitimately qualify as the IRS

set this claim up for the benefit of businesses that need it and were harmed by the pandemic.

With the new administration in play, the nominated (soon to be confirmed), Billy Long has been a

proponent of ERC and was even involved in helping businesses receive it at one time. The Trump

administration created the ERC opportunity in the first place and is back to make sure that businesses

receive what is due to them.