The Echoes of Resilience

In the cramped office of a rural nonprofit last week, a director stared at a ledger bleeding

red—donations down, staff hours slashed. She didn’t know a lifeline lingered: the Employee Retention

Credit (ERC), a 2020 CARES Act gem. It’s been dormant for new claims since 2021, but for those who

held on through that year, there’s still hope—$28,000 per employee, claimable until April 15, 2025.

Enter the new administration, sworn in January 2025, with “ERC Forward”—a mission to breathe life

into this fading relief as the clock ticks down to that final deadline.

A Champion’s Promise

The White House isn’t rewriting the ERC’s rules—the 2020 window shut in 2024—but they’re raising its

flag for 2021. Picture this: a president at a podium, vowing to “unearth every dollar businesses and

nonprofits earned through grit.” ERC Forward isn’t about new funds; it’s about making the old ones

count. They’re pumping $40 million into a campaign—billboards, radio spots, a chatbot on irs.gov—to

reach the overlooked: food banks, tutors, small retailers who don’t know 2021’s $7,000-per-quarter

credit awaits.

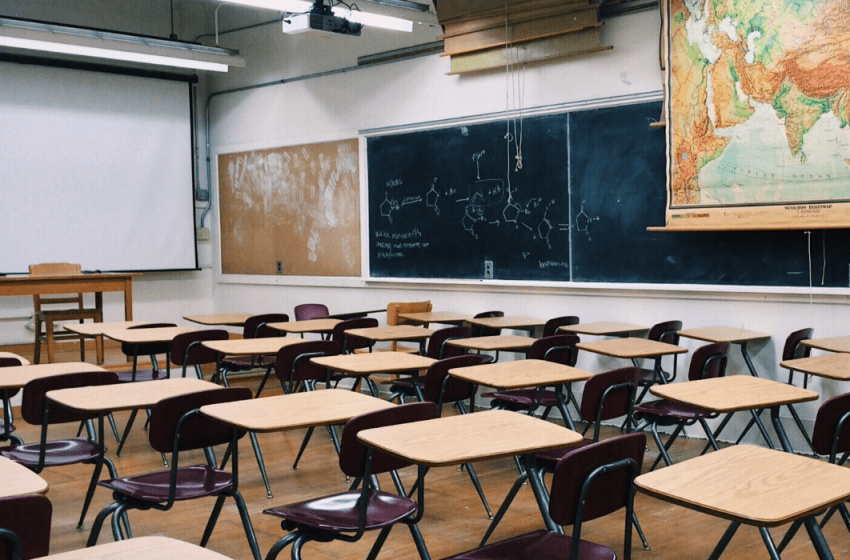

Cutting Through the Red Tape

Ask any accountant: ERC claims have been a slog—180-day delays, a 400,000-case pileup, and a fraud

crackdown that froze new filings until December 2024. The administration’s response? A bulldozer.

They’re hiring 150 IRS agents to blitz through 2021 Form 941-X backlogs, targeting 45-day turnarounds

by June 2025. For a school that kept teachers on despite empty classrooms, that could mean $500,000

by summer—if they file before April 15. Retroactive 2021 is the last dance; this is the music starting up.

Who Gets the Spotlight?

The ERC isn’t for everyone now—just those who toughed out 2021 with a 20% revenue hit (versus 2019)

or faced government orders shutting doors or slashing capacity. Nonprofits shine here—libraries

pivoting to curbside, colleges locked in Zoom limbo. The administration’s handing out cheat sheets: “Did

your state cap attendance? You’re in.” Gross receipts—tuition, grants—count, and pairing it with PPP is

fair game if wages stay distinct. It’s not charity; it’s what you earned.

Shadows of Deception

Fraud’s the dark cloud—crooks bilked billions with fake ERC claims, leaving honest filers in audit hell.

ERC Forward flips the script: a new “Trust Line” lets nonprofits report shady promoters promising easy

cash for 25% cuts. Meanwhile, a 90-day grace period lets past filers fix errors penalty-free.

Documentation—pay stubs, mandate letters—is your shield; stash it four years.

The Last Stand

This isn’t a reboot; it’s a rally cry. With April 15, 2025, five weeks out, ERC Forward’s the administration’s

bet that resilience pays off. A community theater, a daycare—$100,000 could rewrite their next act.

Don’t wait for the IRS to knock; grab your 2021 records, call your tax pro, and file that 941-X. The new

guard’s lighting the way—step up before the flame dies.