The transportation industry has navigated some bumpy roads in recent years, from fuel price spikes to

supply chain snags and pandemic-induced slowdowns. For trucking firms, logistics providers, and other

transportation companies, the Employee Retention Credit (ERC) has served as a vital fuel injection,

offering a refundable tax credit to reward businesses for keeping their drivers and staff employed during

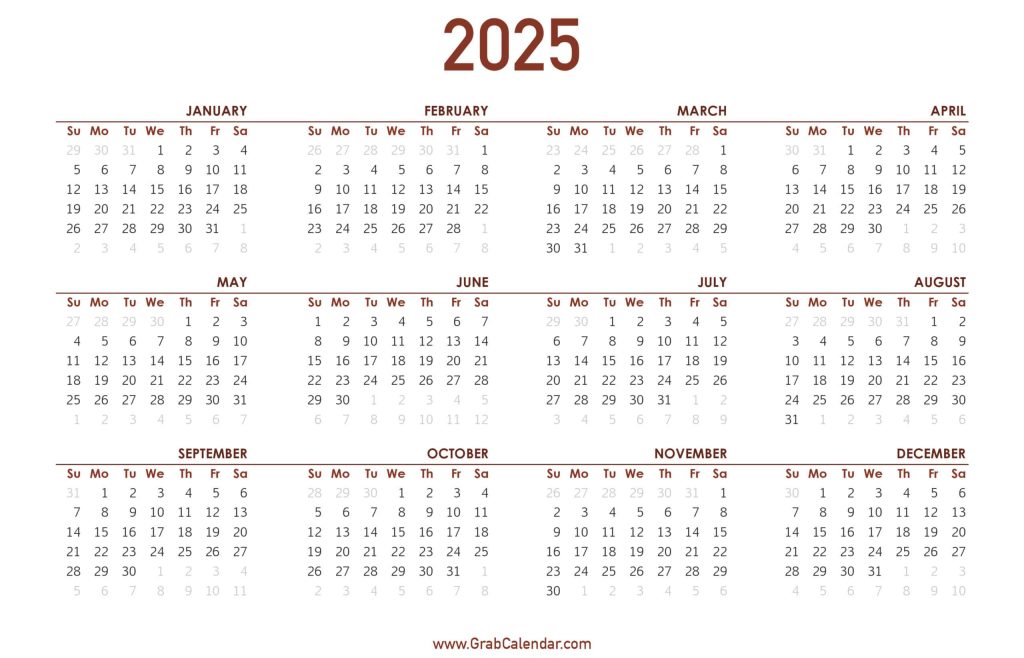

rocky times. But the finish line is in sight: the deadline to claim this credit for 2021 tax periods is April 15,

2025. Transportation companies need to shift into high gear to claim their savings before it’s too late.

What’s the ERC All About?

Launched through the CARES Act in 2020, the ERC was designed to support employers hit hard by

COVID-19. It delivers up to $5,000 per employee for 2020 and as much as $7,000 per employee per

quarter for the first three quarters of 2021—adding up to a possible $26,000 per worker. For

transportation firms with fleets of drivers, dispatchers, and mechanics, this could mean a hefty payout.

To qualify, companies need to show either a sharp drop in revenue (50% less in 2020 or 20% less in 2021

compared to the same period in 2019) or a disruption in operations due to government restrictions, like

travel bans or reduced capacity mandates. Given the transportation sector’s reliance on mobility, many

firms faced such hurdles, positioning them well for the ERC.

Why Transportation Companies Should Accelerate Now

The pandemic threw a wrench into transportation operations—border closures, freight delays, and

quarantine rules stalled deliveries and cut routes. These setbacks often make companies eligible, even if

their income didn’t tank. With the IRS lifting its 2023 pause on ERC applications and new Commissioner

Billy Long steering a pro-ERC course, the path to approval is clearer. But the deadline for 2021

claims—April 15, 2025—won’t budge, and the 2020 cutoff (April 15, 2024) has already passed.

The Cost of Idling

Hesitation could leave money on the table. A transportation company with 25 employees could pocket

up to $525,000 for 2021 if fully eligible. That’s cash to cover rising diesel costs, maintain vehicles, or

recruit drivers in a competitive market. Filing takes effort, though—compiling payroll details, proving

disruptions, and calculating credits. Dawdling risks mistakes or missing the cutoff entirely, as the IRS

won’t extend grace periods. Although this might take effort to get the required info, it will be worth it

and with the help of an ERC CPA firm, the process can be pain-free.

How to Hit the Gas

Check your 2021 records: Did government orders slow your routes or halt operations? Did earnings dip

from 2019 levels? If yes, you’re probably in the clear to claim. Pull together payroll files, like Form 941s, to tally eligible wages. Then, team up with an ERC CPA pro who knows the transportation landscape to submit your amended return accurately and on time.

Fueling Your Future

The ERC isn’t just a rebate—it’s a turbocharge for recovery. Funds can ease financial strain, upgrade

your fleet, or boost pay to retain top talent. A small outfit with 15 workers could claim $315,000 for

2021—game-changing capital for an industry always on the move.

Steer Toward Savings Now

You’ve got under two months until the April 2025 deadline. Don’t let this chance pass you by. Reach out

to a tax advisor, verify your qualifications, and file your ERC for your business before the ERC road closes

on April 15, 2025. Drive toward savings while you still can.